What is Fibonacci Retracement?

A well-known technical analysis tool that many traders use to navigate the erratic markets, Fibonacci Retracement is used to study future potential support and resistance levels based on previous price movement.

The concept of Fibonacci was discovered by Leonardo Fibonacci in 1202 and his mathematical discoveries continues to shape and influence the modern world in various ways. His first discovery was the “Fibonacci Sequence”, referring to a specific mathematical sequence of numbers but what intrigued Leonardo was the ratio among the numbers, more specifically, the ratio 1.618. Dubbed as “The Golden Ratio”, this number exist not only in between the Fibonacci sequence but in the financial markets as well[1].

Key Points

- Fibonacci Retracement is a technical analysis tool used to identify potential support and resistance levels based on past price movements and the ‘Golden Ratio’ of 1.618.

- The tool divides a price swing into levels, offering entry points and targets for take-profit or reversal, enforcing structured trade planning.

- Fibonacci Retracement can be found and utilised in trading platforms like MetaTrader and TradingView, aiding traders from entry to exit points in various market conditions.

Fibonacci Trading: How to Trade Using Fibonacci Retracement

Apart from the famous Fibonacci Retracement, there are many other tools that serve as extensions such as Trend-based Fibonacci Extension, Fibonacci Channel, Fibonacci Time Zone etc.

However, the primary focus would be on the retracement. The application of the Fibonacci Retracement can be applied to many financial instruments on CFDs including the foreign exchange market, stock market, and even the commodities market.

Within the financial markets, by taking two extreme points on a swing trend, the tool divides the area in between, which serves as area of interest for traders to consider a trade. Furthermore, it also provides insight to possible levels of take profit or levels where markets may reverse.

| Fibonacci Retracement Levels | Usage |

| 0%, 100% | For bullish markets, 100% represents the low while 0% represents the high. For bearish markets, 100% represents the highs while 0% represents the low. |

| 23.6%, 38.2%, 50% | Shallow levels of retracement. Generally, it’s not recommended to enter a trade. |

| 61.8%, 78.6% | Deep levels of retracement. Generally, it’s favorable to enter a trade as it provides for better risk to reward ratio. |

| -27%, -68% | Take profit targets 1 & 2, after a successful retracement. |

| 127.2%. 161.8% | Reversal levels 1 & 2, if final retracement level (78.6%) does not hold. |

Fibonacci Retracement Strategy

Just through the Fibonacci Retracement tool alone, a trader can determine four key points; determining the trend (0% & 100%), areas of entry (23.6% to 78.6%), multiple areas to secure profits (-27% & -68%), areas that market would reverse if the main bias does not hold (127.2% & 161.8%).

This essentially enforces structure in every trade, which in turn can help to eliminate human errors.

How to Use Fibonacci Retracement

Through the various case studies discussed below, it will highlight the proper usage of the Fibonacci retracement tool from planning to execution, and to exit strategy. The case studies will touch on both buy and sell examples on different CFDs on currency pairs to show the versatility of this tool.

The examples below are used for educational purposes only. Past performance is not an indication of future results and any reliance on such is at your own risk.

Case Study 1 – Fibonacci Retracement Buy Application

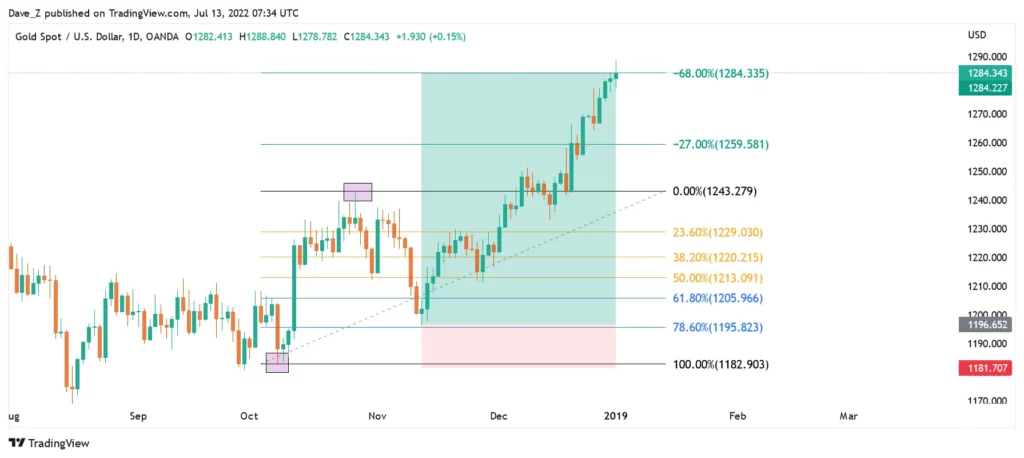

Case study 1 shows a buy trade on XAUUSD using the Fibonacci retracement tool.

Figure 1 – XAUUSD D1 Fibonacci Retracement Buy Application (https://www.tradingview.com/x/sbA18OGg/)

Assuming a bullish bias, figure 1 shows an identification of a swing low to swing high on gold using the Fibonacci Retracement tool as indicated by the purple boxes.

Figure 2 – XAUUSD D1 Fibonacci Retracement Entry Point (https://www.tradingview.com/x/HfIHMdIi/)

In figure 2, gold markets retraced to 78.6% Fibonacci Retracement level which signifies a possible buy trade idea. A general rule of thumb is placing the stop loss one Fibonacci level below the entry, in this case, below the 100% level. The take profit level used would be the -68% level, giving this trade a potential risk to reward ratio of 1:5.8.

Figure 3 – XAUUSD D1 Completed Fibonacci Retracement Buy Trade (https://www.tradingview.com/x/dKwtcv1a/)

Figure 3 shows the gold trade hitting take profit targets 1 and 2, further highlighting how the tool structures a trade from start to end.

Case Study 2 – Fibonacci Retracement Sell Application

Case study 2 shows a sell trade on AUDUSD using the Fibonacci retracement tool.

Figure 4 – AUDUSD D1 Fibonacci Retracement Sell Application (https://www.tradingview.com/x/8MwzqHMd/)

Assuming a bearish market, figure 4 shows AUDUSD with the application of the Fibonacci retracement from a high to a low, indicated by the purple boxes.

Figure 5 – AUDUSD D1 Fibonacci Retracement Entry Point (https://www.tradingview.com/x/nrJctdCz/)

In figure 5, AUDUSD can be seen retracing into the 61.8% level, giving rise to a possible sell trade idea with stop loss one level above the entry (78.6%) and take profit level at -27%. The potential risk to reward for this trade would be 1:5.2.

Figure 6 – AUDUSD D1 Completed Fibonacci Retracement Sell Trade (https://www.tradingview.com/x/YZE0dh6d/)

A completed AUDUSD sell idea in figure 6 with markets hitting Take profit 1 level, emphasizing the trade scaffolding that the Fibonacci Retracement has to offer.

Case Study 3 – Fibonacci Retracement Reversal Levels

At times when the trader’s bias is wrong (bullish bias but bearish market), reversal levels serve to help the adaptive individual to changing market conditions. Case study 3 shows the effective use of Fibonacci’s reversal levels on GBPUSD, switching from a buy to a sell bias.

Figure 7 – GBPUSD D1 Fibonacci Retracement Reversal Application (https://www.tradingview.com/x/KKSx5xPz/)

Note in figure 7, the Fibonacci Retracement is applied with the intent of a GBPUSD buy trade idea, from a swing low to a swing high.

Figure 8 – GBPUSD D1 Buy Retracement Levels Not Holding (https://www.tradingview.com/x/OL1I9YVg/)

In figure 8, the retracement levels do not seem to hold any weight and GBPUSD markets have broken below the 100% level.

Figure 9 – GBPUSD D1 Fibonacci Reversal Sell Idea (https://www.tradingview.com/x/tRbVpdaS/)

Figure 9 showcases an adaptive sell trade idea below the 100% level when the areas of entries do not hold weight, targeting reversal levels 1 & 2, generating a risk to reward ratio of 1:2.3.

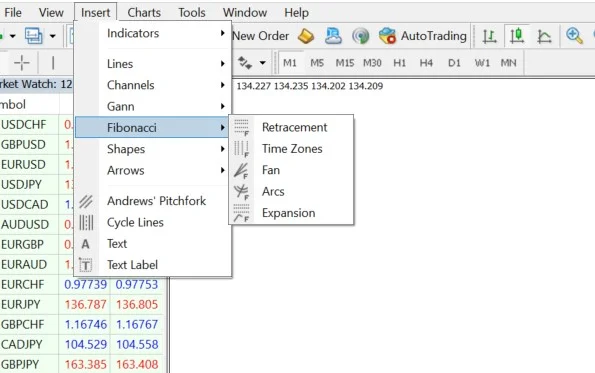

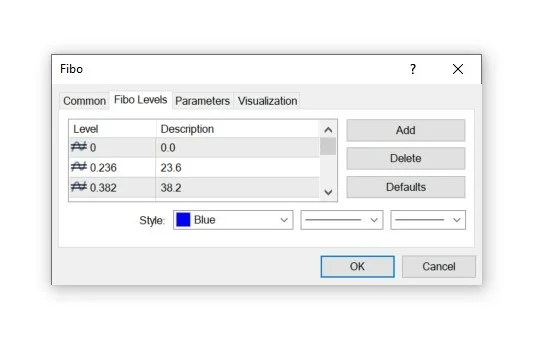

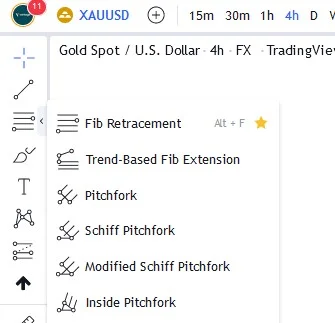

Where to find Fibonacci Retracement in MetaTrader 4/5 (MT4/5) & TradingView

The Fibonacci Retracement tool is not limited to just the mentioned platforms. However, here’s how you can find the Fibonacci Retracement tool on the following platforms.

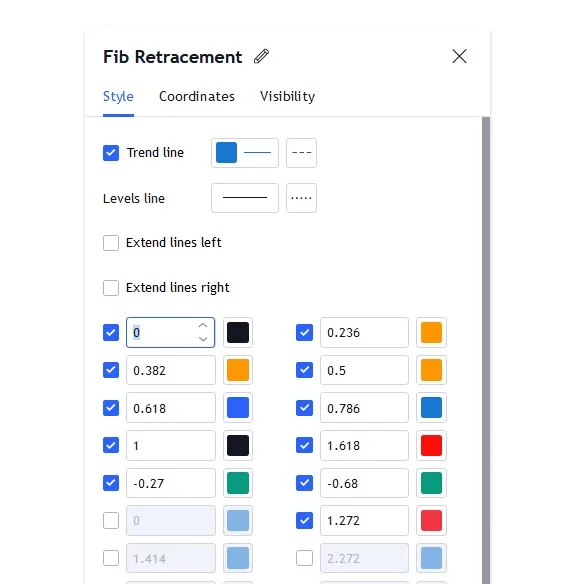

1. MT 4/5 – Insert > Fibonacci > Retracement

2. TradingView – Left toolbar > Fib Retracement

Conclusion

The practical application of the Fibonacci Retracement serves as a scaffolding for every trade from entry points to take profit, and reversal levels. Traders should consider the availability of numerous tools. Nevertheless, the Fibonacci Retracement is an amazing tool to have in one’s trading arsenal.

Can’t wait to apply the secrets of Fibonacci retracement? Try practising it through your own forex demo account.

Start Trading with Vantage

Access markets including forex, commodities, indices, shares/stocks and more, at low cost.

Start trading CFD stocks by opening a live account here, or practice trading with virtual currency with a demo account.

You can also sign up for our free, weekly webinars that will break down the current markets as well as discuss potential trade set ups for the week.

References

[1] Gies, F. C. (n.d.). Fibonacci | Biography, Sequence, & Facts. Encyclopaedia Britannica. Retrieved July 22, 2022, from https://www.britannica.com/biography/Fibonacci

[2] Davis, F. W. (2020, January 16). How to Use Fibonacci Extensions to Increase Your Profitability. Forex With An Edge: Advanced Strategies For Serious Traders. https://forexwithanedge.com/fibonacci-extensions/

[3] Shankar, R. S. (2020, February 25). 67. Using Fibonacci Extensions To Place Accurate Take-Profit Orders. Forex Academy. https://www.forex.academy/67-using-fibonacci-extensions-to-place-accurate-take-profit-orders/