In the financial markets, there is a plethora of financial products that can be traded. Given the right conditions, trading each one of the products can have the potential to create trading opportunities. But in the world of plentiful choices, it is crucial to choose the product that is right for you. In this article, we will address the choices between CFDs and stocks.

CFDs vs Stocks: Which one Suits you?

CFDs can be an option to trade if:

- You use a variety of trading styles based on market conditions

- You like the flexibility and nimbleness to get in and out of markets

- You are interested in trading in a variety of markets (stocks, forex, commodity, options, etc.)

- You don’t care about potentially owning the underlying asset

Stocks can be an alternative choice to trade if:

- You not only want to create trading opportunities for potential gains (which comes with the risk of losses), but you also want to participate in equity growth through ownership and control of the company

- You would like to be entitled to dividends given out by the company

- You have access to a much larger pool of capital

Similarities Between CFDs and Stocks

Both CFDs and stocks have their own similarities and it is important to recognise both their similarities and differences. Here are 3 similarities between CFDs and stocks:

Both Allow You to Take Advantage of Price Movements

A Contract for Difference (CFD) allows traders the opportunity to take advantage of the falling and rising prices of underlying financial assets (the underlying) [1].

A stock also allows both traders and investors to take advantage of the price movement of the shares.

Access to Global Markets

Both CFDs and stocks provide traders access to a wide range of global markets. Traders can trade various global companies listed on various stock exchanges around the world such as the famous The New York Stock Exchange (NYSE), London Stock Exchange, Tokyo Stock Exchange, and many others.

These stock exchanges represent companies from different industries and sectors, allowing traders to diversify their portfolios across the globe.

Accessible through Online Platforms

CFDs and stocks can both be traded on online trading platforms and mobile apps. These platforms offer traders real-time price data, charting tools and order execution capabilities making it convenient for traders to participate in the financial markets.

Interested to start trading online? Open a live account with Vantage in less than five minutes and start trading a broad selection of products via CFDs.

Differences Between CFDs and Stocks

| CFDs | Stocks (also referred to as shares) | |

| Flexible trading style | Can work for any trading style (scalping, day-trading, swing-trading) | Best suited for swing traders and investors who are interested in the ownership of shares. Pattern Day Trading (PDT) rule applies to US traders |

| Short selling | Straight-forward procedure | Need to borrow shares from your broker |

| Transaction costs | Spreads and swaps | Brokerage commission |

| Leveraged product | Leverage is built in | Need to have a margin account, not a cash account, to get margin |

| Derivative product | A derivative product with flexible underlying | Not a derivative product |

1. CFDs are Leveraged Products

CFDs are a leveraged product, which means that you only need to deposit a small percentage of the full value of the position in order to open a position – you will be trading on margin, which is the amount of money you need to open a position. Margin trading gives you full exposure to the market while using only a small fraction of the capital otherwise needed.

Leveraged trading can work well for those trading short-term price movements due to the cost of borrowing whereas it would not be primarily preferred e for anyone investing long-term [2].

Stock trading has two types of accounts: cash and margin accounts. Cash accounts will give you no margin. On a margin account, however, you borrow money from the broker using the securities in your brokerage account as collateral. As with any loan, you need to meet the maintenance requirements, which varies from broker to broker.

2. CFDs are Derivative Products

CFDs allow traders to take advantage of the falling and rising prices of underlying financial assets (the underlying). The fact that CFDs are derivative products means that they have a large variety of underlying for traders to choose from, such as stocks, commodities, forex, precious metals, and even options contracts. The price of the CFD is driven by the price of the underlying [3].

When the contract ends, the trader and the broker exchange the difference between a specific asset’s opening and closing prices. The trades can result in either a profit or a loss, depending on the direction that you have chosen.

A stock is not a derivative product. It represents a fraction of the publicly listed company, and the buyer of the stock owns a fraction of the company. A stock’s price, therefore, represents the company’s market value.

3. CFDs Enable Short-selling

Traders can short a CFD position to possibly take advantage of falling markets. For example, you wish to trade Intel’s shares through CFDs at $2,060. You decided to take the short side of the trade for 50 contracts and will close the position as soon as the share price reaches $1,750 per share. This trade can potentially make a $250 profit since ($2,060-$1,750)*50 = $15,500. (This example is provided for illustration purposes only).

The owner of the stock always has a long position.

Stock traders who want to sell short are required to borrow shares from the broker. You then sell those and repurchase them later at a lower rate to take advantage of the falling markets. However, it can be difficult to borrow, especially for thinly traded stocks [4].

It should be noted that when it comes to retail stock trading, borrowing shares from the broker is necessary. Selling short without first borrowing the stock, or at least first determining that it can be borrowed is referred to naked shorting – an illegal practice, as it can potentially lead to a failure to deliver [5].

4. Transaction and Financing Costs

When trading CFDs, you incur transaction costs (bid-ask spread, or spread plus a small commission for direct market access, depending on your provider and your account type), as well as overnight swap fees. When trading options, you only pay the broker commissions [6].

When you trade stocks directly, you could incur costs such as commission fees, exchange fees and custodian fees.

5. CFDs Allow Flexible Trading Styles Without PDT Rule

Are you a day-trader, scalper, or swing dealer? Do you primarily follow one pattern, or are you sometimes inclined to vary how long you stay in your positions based on what the market outlook is? CFDs can provide you with maximum trade flexibility for your preferred trading style [7].

Contrast this with the situation in which you’re purchasing stocks. Yours or your broker’s jurisdiction will determine whether or not your broker is actively day trading stocks. If so, you will be subject to Pattern Day Trading (PDT) rules for each margin account that you are actively day trading stocks. This could make it challenging for small accounts [8].

Example of Trading CFDs vs. Stocks

Let’s run through a hypothetical trading example to compare trading in CFDs vs stocks. Here are the assumptions:

1. Stock symbol: ABC

2. Stock price: $100 per share

3. Trading timeline: 1 year

4. CFD Leverage: 100:1

Example of How CFD Trading Works

Please be aware that while trading CFDs, traders may encounter additional fees imposed by the broker for keeping a position open overnight. It is important for traders to comprehend the potential charges before engaging in any long-term CFD trades.

For this example, we will ignore these charges and focus on the basic aspects of CFD trading.

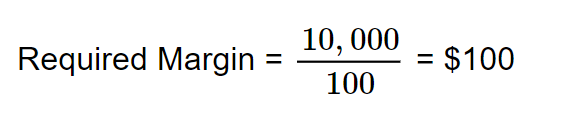

In CFD trading, traders can open a position larger than their available funds by using leverage. If a trader wants to control an open trade worth $10,000 in stock, they would only need $100 as the required margin. This is made possible by using a leverage ratio of 100:1, allowing them to control a $10,000 trade position (100 shares) with just $100.

Here’s the calculation:

Leverage: 100:1

Desired Position Value: $10,000

with a Desired Position Value of $10,000 and a Leverage Ratio of 100:1, the required margin would be:

Example of How Stock Trading Works

In stock trading, traders buy and sell shares of a company on the stock market. Unlike CFD trading, there is typically no leverage involved in stock trading. Traders are required to have the full funds needed to trade the entire value of the shares.

In stock trading, traders buy and sell shares of a company on the stock market. Unlike CFD trading, there is no leverage involved; traders invest in the full value of the shares.

The total cost for buying the shares can be calculated using the formula below:

Fund required = Number of Shares * Price per Share = 100 * 100 = $10,000

So, a trader would require $10,000 to purchase 100 shares of company ABC, and if the stock price rises, the trader would make a profit (minus the costs incurred). Alternatively, if the stock price goes down, the trader would incur a loss.

Here is a table showing the calculation between the two examples and the fund required:

| Aspect | CFD Trading | Stock Trading |

| Leverage | 100:1 | No leverage involved |

| Desired Position Value | $10,000 | $10,000 |

| Total Cost for Buying | $100 | $10,000 |

Conclusion

In conclusion, for short-term private investors who are not interested in holding an investment for the long term, CFDs can be a way of creating trading opportunities from the price movements. By leveraging CFDs, investors can take advantage of market opportunities. If you tend to hold trades for a longer time frame that is greater than four to six weeks, and are interested in sharing the control of the company, stocks may be a good choice for you.

References

- “An Introduction to Contract for Differences (CFDs) – Investopedia.”. https://www.investopedia.com/articles/stocks/09/trade-a-cfd.asp . Accessed 7 Apr. 2022.

- “What Type of Trader Are You? – Investopedia.”. https://www.investopedia.com/articles/investing/052413/what-type-trader-are-you.asp . Accessed 8 Apr. 2022.

- “Pattern day trader – Wikipedia.”. https://en.wikipedia.org/wiki/Pattern_day_trader . Accessed 8 Apr. 2022.

- “Short Selling – Corporate Finance Institute.”. https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/short-selling/ . Accessed 8 Apr. 2022.

- “The Truth About Naked Short Selling – Investopedia”. https://www.investopedia.com/articles/optioninvestor/09/naked-short-selling.asp . Accessed 13 Apr. 2022.

- “How CFD Pricing Works | Contracts-For-Difference.com.”. https://www.contracts-for-difference.com/cfds-pricing.html . Accessed 8 Apr. 2022.

- “Leverage – Guide, Examples, Formula for Financial & Operating ….”. https://corporatefinanceinstitute.com/resources/knowledge/finance/leverage/ . Accessed 8 Apr. 2022.

- “The underlying assets of CFDs – Forex-Central.net.” . http://www.forex-central.net/cfd-underlying-assets.php . Accessed 8 Apr. 2022.