Quiet holiday trade as markets eye US non-farm payrolls

Headlines

* Investors prepare for big labour win in UK election

* Le Pen rivals gain momentum as political heads warn of chaos

* Minutes of ECB’s June meeting reveal dissenting views on rate cuts

* Gold trades with caution above $2350 as focus shifts to US NFP

FX: USD traded lower for a sixth day in a row. That was last seen in March. Prices closed near their lows for the day on the 50-day SMA at 105.14 and below the long-term bull trendline. Weak US macro data has hit the greenback with the dreadful ISM services data depicting a slowing economy.

EUR pushed higher and closed above 1.08 and its 200-day SMA at 1.0794. Focus is on NFP but then the second voting round in France on Sunday.

GBP moved north for a sixth straight day. The UK election and a big Labour victory have been priced into markets for some time. Their move to the centre ground has helped soothe market nerves. The recent June spike high is 1.2860.

USD/JPY dropped as the dollar succumbed to selling pressure. There was some speculation about intervention coming on a US holiday, but this does not seem to have been the case. The previous spike high in late April was 160.20.

AUD built on its break to the upside yesterday trying to near the new cycle high at 0.6733, a level last seen in early January. CAD appreciated which saw the major drop again, closer to the 200-day SMA at 1.3594.

US Stocks: US markets were closed for Independence Day July 4 celebrations.

Asian stock futures are mixed. Asian stocks were mostly in the green after more record highs on Wall Street. The ASX 200 outperformed led by the commodity sector. The Nikkei 225 moved closer to the 41,000 barrier. The Hang Seng lagged, trading uncertainly. The Shanghai Composite continued its pullback away from 3,000.

Gold traded in a tiny range printing a doji candle. The top at $2362 was the highest in a month. Treasury markets were closed, and the dollar sold off.

Day Ahead – NFP Day!

Nonfarm payrolls growth saw a sharp slowdown in April, but the headline number then re-accelerated to 272,000 in May. Cooling is predicted again in June with a print of 190,000. That would be slower than the three-month average of 249,000 and the 12-month average of 230,000. The unemployment rate is expected to remain unchanged at 4.0%. Interestingly, the Fed’s June Summary of Economic Projections pencilled in a similar rate for the end of this year, rising to 4.2% next year. The rate of average hourly earnings growth is seen easing one-tenth to +0.3% m/m and 4.1% y/y.

We’ve had a series of weaker data this week offering more evidence of a cooling economy and weaker labour market. Both ISMs are now below 50 in contraction territory. This is a significant story as historically these have been the best lead indicators for changes in the economic cycle and suggest downside growth risks are intensifying.

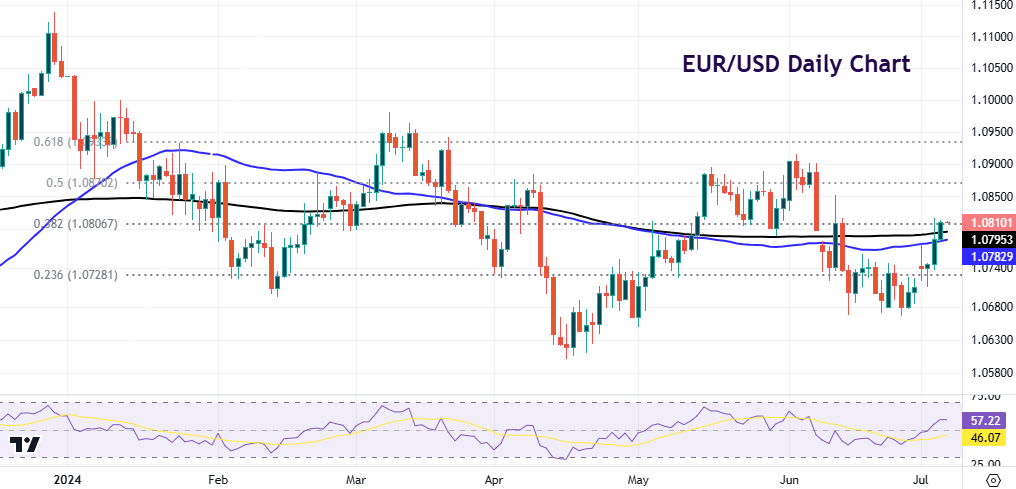

Chart of the day – EUR/USD into major risk events

The world’s most popular currency pair faces major risk events in the next 48 hours or so, with the NFP data later today and French elections on Sunday. Market nerves have eased around the latter recently as the chances of a hung parliament in France have been raised. This is due to numerous centre and left- wing candidates dropping out of three-way runoffs to curb Le Pen’s NR party.

Regarding NFP, further weakness in the headline print and a higher jobless rate could see markets start to bake in a September rate cut. Money markets currently see above a 70% chance of this happening. But a very soft report could spark fears over an incoming slightly harder landing, which could upset the fairly tranquil market mood that has pervaded investors for some weeks.

A strong report would mean markets start pricing out the chances of a September rate cut. That would mean potentially aligning more with the most recent Fed dot plot of just one rate cut this year. The dollar would move higher while stocks and gold could sell-off.