Stocks, USD rise, Bitcoin nears $100,000

* Wall Street finished higher as markets digested Nvidia and Google news

* Dollar hit a 13-month high after better-than-expected labour market data

* Geopolitical tensions lifted gold and oil prices

* Bitcoin posted a fresh record top above $99,000

FX: USD breached 107 as the bull flag we talked about yesterday looks to be acting as it should. The prior year-to-date top at 106.51 might now be support with the October 2023 peak at 107.34 in sight. Geopolitical tensions linger in Ukraine. US weekly initial jobless claims numbers surprisingly fell below estimates to their lowest since April.

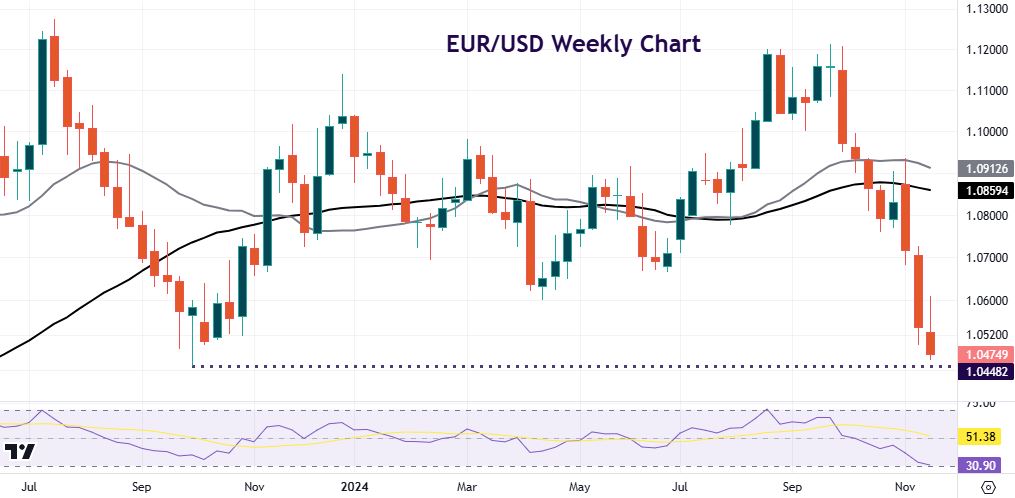

EUR broke down and now threatens the long-term October 2023 level at 1.0448. A ratcheting up in the Ukraine/Russia conflict bodes ill. The latest EZ consumer confidence data continued to disappoint, dropping to its lowest level since June. There were dovish remarks from ECB official Villeroy. He said risks were tilting to the downside and the ECB should continue to ease restrictive policy.

GBP also broke down, easing past last week’s low at 1.2596. Hawkish BoE member Mann said that 100bps of cuts is too aggressive. Retail sales are released today, and seen falling 0.3% after posting 0.3% growth in September.

USD/JPY slid as yen strength came to the fore as a safe haven. Support sits at 153.40. BoJ’s Governor Ueda largely reiterated the policy narrative of data dependency and refrained from commenting on short-term exchange rate moves.

AUD held up actually printing very marginally higher on the day. USD/CAD dipped below the August spike high at 1.3946. Firmer crude prices initially helped the loonie.

US Stocks were positive. The S&P 500 settled higher at 5,949. The tech-dominated Nasdaq 100 added 0.36% to finish at 20,741. The Dow closed up 1.06% at 43,870. Utilities led the gainers by some distance while only two sectors, communication services and consumer discretionary, were in the red. The former was dragged down by Alphabet, which closed off 4.56%. US prosecutors argued the company must divest its popular Chrome browser to end Google’s search monopoly. Nvidia shares hit a record high early in the session before paring some of the gains. The giant chipmaker, the world’s most valuable company, forecast its slowest revenue growth in seven quarters.

Asian stocks: Futures are in the green. Asian equities were muted with geopolitical tensions evident and investors waiting for Nvidia’s Q3 results. The ASX 200 saw consumer-related sector weakness but lacked any firm direction. The Nikkei 225 underperformed which saw a test of the 38,000 psychological level. The Hang Seng and Shanghai Composite were subdued with investors digesting recent earnings.

Gold moved higher for a fourth straight day as prices moved just above the 100-day SMA at $2660. This rebound has retraced around half of the 9% decline seen since record highs in late October.

Day Ahead – Eurozone & UK PMIs

Eurozone manufacturing PMI is expected to remain at 46.0. But there are downside risks due to rising uncertainty following the US elections. The services PMI is forecast to tick up to 52.0 from 51.6. Overall, this is predicted to push eurozone PMI down below 50 in November into contraction.

UK PMIs dropped back a little in October, in what appears to be a case of ‘pre-Budget blues’. Unfortunately, the event itself lacked many positive surprises. That means sentiment might have continued to deteriorate, with the market’s hawkish reassessment of the prospect of rate cuts. The US election may also play a part which all-in should see realtive stabilisation in the data with the composite still decently above 50.

Chart of the Day – EUR/USD breakdown

It’s been a bad month so far for the euro. Currently, the single currency is off 3.75%, its worst month so far since April 2022. The Trump tariff threat and now an escalation of geopolitical tensions on its borders are not a good look. Some are also talking about Europe’s gas inventories which are now just below their five-year average for this time of year. We note the gas price spike in 2022 and the damage that caused the euro.

Bearish price signals around the early week highs near 1.06 leave the major looking prone to further softness in the short and medium term. A clear break and weekly close under the recent low at 1.0495 implies more downside. That menas a test of key support at 1.0448 and then 1.0340. That is a long-term low from January 2017.