Tech climbs higher amid quiet, choppy trading

Headlines

* Nasdaq rises to another record led by Nvidia, but Dow dips below 40k

* Dollar holds steady as investors look to data, Fed speaker comments

* “Perfect storm” steers gold to another record high, silver jumps

* Two Fed governors see holding rates for longer amid slow-moving inflation

FX: USD traded marginally higher with the index trading in a narrow 26 pip range. The 200-day SMA sits at 104.35 while the 50-day SMA is above at 104.83. Little new was said by a bunch of Fed officials. Markets await Nvidia earnings after the US closing bell on Wednesday.

EUR traded modestly lower in quiet trade. One ECB member affirmed a June rate cut. The most important data this week will be the PMI figures out on Thursday.

GBP traded in the green closing above 1.27. Eyes are on UK CPI data released on Wednesday.

USD/JPY moved higher for a third straight day with the major settling above 156. Major data this week comes in the form of Japan CPI published on Friday.

AUD lost ground but consolidated just below 0.67. USD/CAD traded in a narrow range just above 1.36.

Stocks: US equities were choppy and very mixed in thin news flow. The S&P 500 closed 0.09% higher at 5308. The tech-dominated Nasdaq 100 added 0.69% to finish at 18,674. The Dow Jones settled down 0.50% at 39,807. There was much focus on Nvidia as various brokers lifted their price targets ahead of the chip giant’s results. Tech led the way while financials lagged, weighed down by JPMorgan after CEO Dimon said the investment bank is not going to engage in buybacks at these prices.

Asian Stocks: APAC futures are mixed. Asian stocks were in the green despite Wall Street’s muted performance on Friday. The ASX 200 went higher on miners boosted by record gold and copper prices. The Nikkei 225 advanced above 39k with the weaker yen helping. The Hang Seng and Shanghai Comp were positive though Sino-US frictions bubble under the surface.

Gold hit a fresh record high at $2450. But prices pulled back and closed below the prior top from April at $2431. Safe haven buying was initially sited as bullion ramped up. But gold was also bought on Friday after real yields moved higher – normally a headwind for bugs. Copper spiked higher to a new top close to $5.20. A short squeeze and long-term positive drivers are boosting demand.

Day Ahead –RBA minutes, Canada CPI

The RBA minutes, as with any central bank log, will give markets some colour on what policymakers are currently thinking and the policy outlook. At the meeting, the bank said it didn’t rule anything in or out regarding rates. It is determined to return inflation to target, having raised its forecasts. These were extended so that rates stay at 4.35% until the middle of next year. AUD has been strong recently with help from positive risk sentiment and a hawkish central bank.

All three core Canada CPI prints fell below 3% in March. This has seen markets bring forward rate cuts. There is near a coin toss for a move at the BoC June 5 meeting. Rising gas prices pose an upside risk to prices with rate setters keen to see disinflation sustained over a number of reports. Money markets price in more than two 25bps rate cuts in total for 2024.

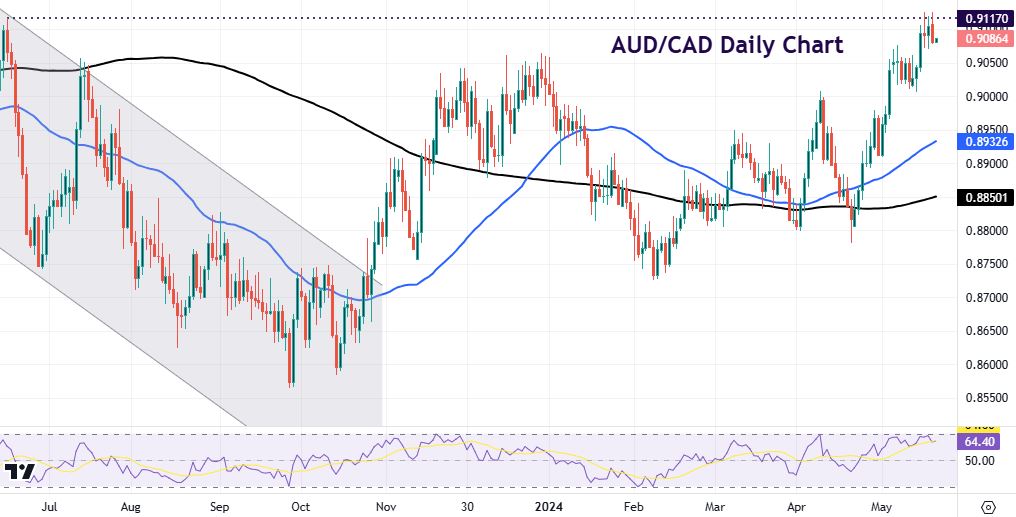

Chart of the Day – AUD/CAD consolidating near 11-month highs

The battle of two of the commodity dollar currencies is being won by the aussie at present. It’s a tale of two central banks, as per above, at the near opposite ends of the cut/hike spectrum. Iron ore has also been strong and helping AUD, while oil and crude less so to support the loonie.

Prices in the cross have now hit resistance and levels last seen in June 2023 just above 0.91. Support comes in just above 0.90 where we had previous consolidation. But if we hold above 0.9076, we could just be tracking sideways before a bust through 0.9117 to new cycle highs with an initial target at 0.9228/31.