Patient Powell pushes yields and dollar higher

Headlines

* Powell says likely to take longer to meet conditions for cuts

* USD/JPY traders brace for 155 level as US Treasury yields advance further

* ECB’s Lagarde says will cut rates soon, barring any major surprises

* Canadian dollar remains weak on mixed CPI and hawkish Powell

FX: USD made fresh cycle highs, up for a fifth consecutive day. Prices are overbought on several measures on the DXY. Fed Chair Powell walked back comments around rate cuts, with just 40bps of cuts priced in for the year. And risk appetite remains fragile. There’s also been added pressure from the lower CNY fixing. The China authorities seem to be allowing a weaker renminbi. This has added pressure on regional FX. But ultimately, rates will decide the level of the dollar. The two-year Treasury yield is consolidating below 5%.

EUR dipped to 1.0601 before printing a doji candle. The German ZEW business survey came in better than expected. Lower rates and prices are expected. This is helping a modest improvement in growth prospects, though they are still sluggish. Near-term support is at a Fib level of the Q4 rally at 1.0596.

GBP slid to a new low just above 1.24. UK data was mixed. The jobless rate picked up, but this data is prone to sampling issues. Wage growth was sticky, stuck just below 6%. Eyes are on today’s CPI figures. Support in cable is at 1.2364.

USD/JPY continued higher as everyone waits for intervention. We talked already about weaker regional FX. Plus, firmer US rates are helping the major. The 10-year Treasury yield is powering ahead, hitting 4.69%.

AUD sold off aggressively again. The mid-February year-to-date low at 0.6442 looks to have been broken decisively. Next support is 0.6338. There was mixed China data with better GDP but softer retail sales. USD/CAD jumped up for a fifth straight day above 1.38. CPI printed lower than expected putting in play a June rate cut, with pricing now at 55%.

Stocks: US equities were choppy amid hawkish Fed speeches and mixed earnings reports. The broad-based benchmark S&P 500 finished 0.21% lower at 5051. The tech-dominated Nasdaq 100 added 0.04% to close at 17,713. The Dow Jones gained 0.17% at 37,798 halting a six-day losing streak. Bank results were mixed with Morgan Stanley up on strong Wealth Management revenue while Bank of America was sold. Apple finished lower with insider sales from COO and CFO. Tesla was in the red again closing below support at $160.51. JP Morgan said the announced 10% layoffs reveal that the delivery miss is about demand and not supply.

Asian Stocks: APAC futures are mixed. Markets were lower as global risk sentiment got hit on Middle East tensions. The Nikkei 225 was among the worst affected as the index dropped below 38,500. The ASX 200 retreated with selling in all sectors.

Gold took a breather near the top of its recent surge, printing a doji. Yields cranked up while the dollar was steady.

Day Ahead – UK CPI

Falling prices are forecast in tomorrow’s UK inflation report, with the headline predicted to slide to 3.1% from 3.4% in February. That data would have got a boost from the early Easter holiday, but last year’s big price rises continue to drop out of the annual comparison, while food and core goods prices should also drag the headline lower. Going forward, the headline may be affected by rising petrol prices though policymakers do focus more on core readings and services inflation data.

The March services print could come in below the MPC’s recent estimate of 6%, while the annual core rate, which strips out volatile food and energy costs, is seen ticking two-tenths lower to 4.3%. The Easter effects will reverse in April bringing down services inflation much closer to 5%, with the MPC forecast at 5.3%.

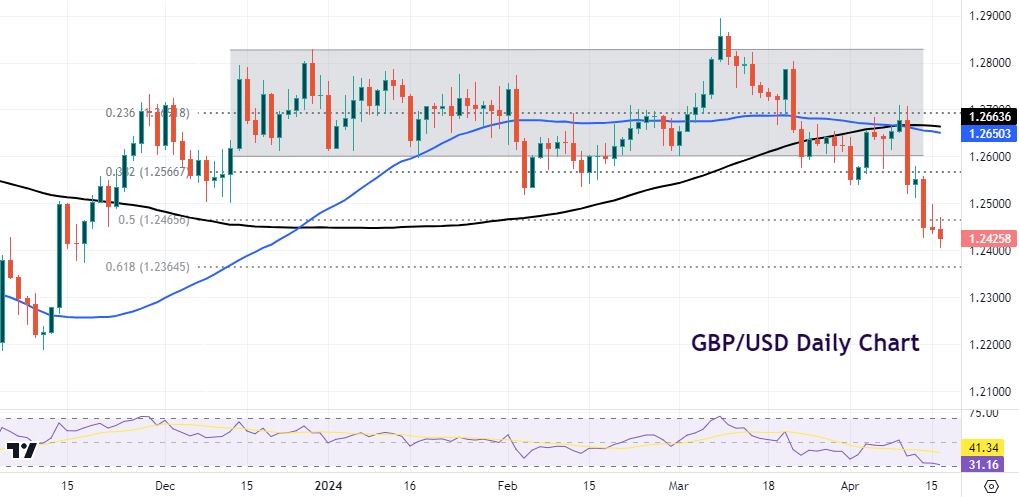

Chart of the Day – Cable struggling to hold onto support

Cable recently broke down through the floor of the sideways range it had been trading in since December. Any material downside to the CPI figures will spark further selling in the pound versus the dollar. Next support is at 1.2364, a major retracement Fib level of the Q4 rally. Central bank divergence is fast becoming a key theme for markets and a patient Fed stands in sharp contrast to a potentially rate-cutting BoE.

But if price pressures remain sticky, sterling could find some support. Indeed, it might fare better against the euro, as the ECB is happy to be out on its own in policy easing with a June rate cut currently nailed on by money markets. Persistent inflation in the UK could mean the Old Lady waits a little longer to be sure price pressures are nearer to target. Prices face resistance at 1.2465 and 1.2566.