Benign US CPI helps tech stocks, eyes on ECB

* Dollar rises again as inflation data reinforces Fed hopes

* Gold move higher close to resistance around $2720 after haven buying

* Nasdaq breaks higher to fresh record highs as tech leads the indices

* ECB and SNB both expected to cut rates, but by different amounts

FX: USD advanced higher for a fourth day in a row. The buck was given a helping hand by news that China may be considering allowing the yuan to weaken next year as Trump tariffs loom. US CPI printed in line with moderating rent prices, which nailed on a 25bp rate cut next week by the FOMC. The next upside target for bull is 107.34, if it can consolidate its recent move above 106.51.

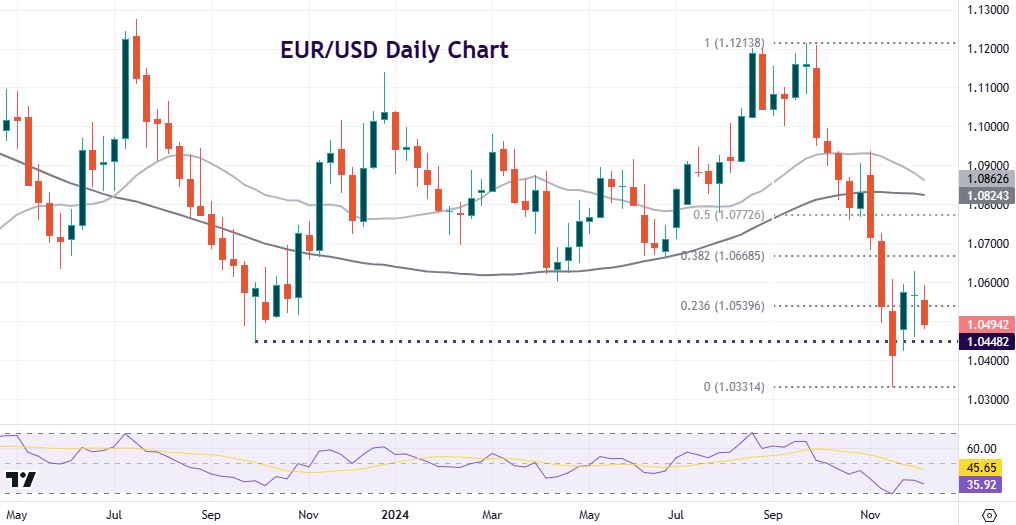

EUR moved down for a fourth straight day and looks to be rolling over below 1.05. A 25bps rate cut is fully priced in for Thursday’s ECB policy decision so markets will be checking the statement and Lagarde for guidance. The SNB also meet today where there is above a 60% chance of a 50bps rate cut.

GBP was mixed, reversing some of its losses. Cable has traded around 1.2729 over the past few days. That is a major Fib retracement (61.8%) of the April to September move north. The EUR/GBP breakdown continued towards 0.8202. Markets think BoE rate cut pricing will follow the US more closely than Europe.

USD/JPY moved higher for a third day in a row. The 21-day SMA sits at 152.60 and the 200-day SMA at 152. The BoJ is said to see less risk of a softer JPY boosting inflation. That ultimately means less pressure to intervene. The 10-year US Treasury yield again ticked higher, moving above its 200-day SMA at 4.20%.

AUD dipped below the August spike low at 0.6347 before paring losses. Australia job data should show solid job gains, with consensus expecting 25k and an unemployment rate of 4.2%. USD/CAD sold off as the loonie appreciated after the BoC’s 50bps rate cut. The rate reduction was expected by markets, but Governor Macklem said the bank will be taking a ‘more gradual approach’ going forward. Major resistance is at the November spike high at 1.4177.

US stocks: US stocks were mixed with megacap tech stocks leading the gains. The S&P500 closed up 0.82% at 6,084. The tech-laden Nasdaq settled 1.85% higher at 21,762. The Dow finished at 44,148, off 0.22%. Google parent, Alphabet, hit a record peak and again led the tech titans, up over 5% and over 11% on the week. The big driver has been two-fold with Trump’s pick to lead the antitrust agency likely meaning the case against Alphabet could be ended. We also had the announcement of a breakthrough in performance of its quantum chip Willow. This performed calculations in minutes that would take standard supercomputers trillions of years. Tesla also posted a new record high, above the level from November 2021 at $414.50.

Asian stocks: Futures are mixed. Asian equities traded mixed after the weakness seen Stateside. Investors also continued to weigh up the China policy stance. The ASX 200 struggled with tech the laggard. The Nikkei 225 was muted as attention is increasingly turning to next week’s BoJ meeting. China indices were better bid initially but faded as focus shifted to the Central Economic Work Conference.

Gold is back in ‘Santa’ rally territory, currently up 2.4% on the month and on track for an unprecedented eighth consecutive December gain. Central bank buying, geopolitical tensions around Syria, and traders adding fresh longs following the November correction are all drivers of the bull move. Some resistance is likely to be found ahead of $2720.

Day Ahead – ECB Meeting

The ECB is fully expected to cut rates for a fourth time this year. A 25bps move is most likely, which would take the deposit rate to 3%. There was speculation a few months ago that a bigger half-point reduction was possible, but most ECB officials have only been hinting at the smaller move for this meeting. Growth concerns are front and centre for the ECB, overtaking worries about inflation. The headline has increased from a three-year low, mainly due to base effects. But the monthly increase in core inflation is well in line with 2% annualised inflation. Crucially, this has been driven by services inflation where momentum is also quickly nearing the 2% target.

Markets will be watching the statement for any material changes around guidance. Many observers predict the bank may abandon its mantra that monetary policy will remain “sufficiently restrictive for as long as necessary” to achieve price stability. Following the disinflationary process that has gained traction through 2024, the updated staff projections are likely to forecast inflation hitting the ECB’s 2% target from 2025 and onwards. So, whether monetary policy should stay restrictive is likely going to be debated with the two opposing hawkish and dovish camps battling it out.

Chart of the Day – EUR/USD pointing lower…

Post-decision communication will be the main driver of volatility in markets. A dovish 25bp cut, in which the ECB signals it is open to bigger size rate cut moves, could see some euro selling. That said, some of this may already be priced in. For us, the long-term low at 1.0448 is key and needs to be broken decisively for more downside. If the bank sticks to quarter-point increments, there could be a modest euro rally, though this may be caveated with the data dependent meeting-by-meeting approach. Buyers need to get above Friday’s high at 1.0629 to slow the long-term downtrend.