If you’ve been following the US Presidential Elections, chances are you’ve heard about the Trump Trade. This is a loosely defined collection of trade ideas and investment strategies based on policy changes and sector developments that are likely to take place should Trump win the presidency.

Generally, the ideas presented in the Trump Trade are based on a combination of Trump’s past actions in office, as well as recent remarks made on the campaign trail. For better or worse, American Presidents do have the power to shape or influence policies; this helps to explain the buzz behind the Trump Trade.

But what if Harris wins the presidential race? How would policies change, and which sectors should investors be paying attention to?

Key Points

- A Harris presidency could benefit sectors like clean energy, healthcare, and technology due to her policy focus on innovation and social welfare.

- Bond yields may rise under Harris, as her administration is expected to support lower inflation and interest rate cuts, boosting the bond market.

- The US dollar is likely to weaken if Harris wins, driven by expected rate cuts and the unwinding of Trump-era trades.

Understanding the “Harris Trade”?

In contrast to Trump, who spent four years at the helm of the White House, Harris’ leadership experience is limited to her stint as Vice-President under Biden. Because of this, the extent of her influence on policy-making is obscured, making it difficult to discern the impact of her decisions.

Furthermore, Harris has only recently begun to express her views on economic and political issues as a presidential candidate, with media coverage on her policies only beginning in earnest from end-July 2024, when she was pipped to take over from Biden.

In short, the Harris Trade has no track record, so more caution is warranted when attempting to build a trading strategy based on a Harris victory.

This is also a great time to remind ourselves that historically speaking, who wins the election has little bearing on the greater performance of the US stock market, and any movements arising from the influence of individual candidates is, at best, short-lived. Ultimately, it is economic fundamentals that the stock market is far more likely to respond to [1].

What we know about Harris so far

Harris is, of course, a Democrat, which means we can expect her to continue pushing for certain goals which are important to the party, such as clean energy and climate change, public healthcare and social welfare issues, and technology, given the Democrats’ focus on fostering innovation.

In terms of background, Harris is a practitioner of law, with some of her more visible roles being District Attorney of San Francisco and Attorney General of California, besides spending some time as a United States Senator [2]. As such, we can expect Harris to be less sympathetic to business interests, while paying more attention to social issues such as equality.

Overall, Harris is a less volatile candidate than Trump, and her administration is regarded as less likely to create surprises or court controversies. Whether this more measured approach would be a boon or a bane to the US – customarily expected to take the lead on the world stage – remains to be seen.

What do the latest polls say?

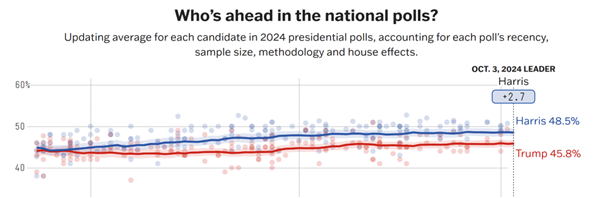

While Harris is relatively untested compared to Trump, this doesn’t seem to be a problem for voters. The following screenshot shows how both candidates are shaping up against each other.

As at 7 October 2024 – slightly a month before the vote – Harris is polling slightly ahead of Trump by around 2 points, according to ABC News [3].

This means that Harris has a more-then-credible chance of winning the seat, making the case for investors and traders to pay attention. In any case, with such tight polling results, we can expect the US Presidential Election to be an extremely close race

What to expect if Harris wins the US presidency

Here’s our rundown of the potential economic outcomes that could arise from a Harris victory in the White House.

Impact on bond yields

A Harris win is expected to be good for the bond market, as her administration is expected to move away from moves that could keep inflation up. Harris is expected to pursue a less aggressive stance in global trade; certainly, we won’t see Trump-style wide-ranging tariffs aimed at enhancing competitiveness for American businesses by artificially jacking up the prices of imported goods.

Instead, with trade kept relatively open, the US Federal Reserve has more room to continue cutting interest rates. As bond prices go up when yields go down, this could lead to an uplift in the bond market.

Impact on the stock market [4,5]

The good news is, the US stock market generally does well during election years. While getting off to a slow start in the first quarter, the S&P 500 typically climbs through summer. As November approaches, the market tends to trade sideways – a manifestation of investor uncertainty – before mounting a rally in the wake of the electoral results.

On average, the S&P 500 has finished election years up by 6.8%. But when split along party lines, the numbers tilt in favour of the blues. Since 1945, the market has averaged an 11% annual return under Democratic presidents and a 7% annual return under Republicans.

Past results are certainly no guarantee of future performance, but if history is any guide, we can expect the US stock market to close the year on a high.

Impact on the US Dollar

With Harris in the White House, the Fed will likely gain policy support to continue cutting interest rates. As rates fall, the US Dollar would weaken in tandem; this is because lowering interest rates also reduces demand for US bonds. This leads to a drop in demand for the US Dollar [6].

As the currency exchange rate is based on supply and demand, when demand for the Dollar falls, so too would the exchange rate. This would see the Dollar weaken against other currencies.

Curiously, the US Dollar is already starting to weaken as the likelihood of a Harris win increases. The reason for this development is thought to be the unwinding of several Trump Trades – speculative bets that are expected to pay off if Trump wins the election [7].

Sector-specific developments to watch if Harris wins [8,9]

Clean energy and renewables

One of Harris’ core campaign promises is to push for increased clean energy, and reduce dependency on fossil fuels. As such, if she takes over the presidency, we can expect the green energy sector to benefit from preferential policies such as tax cuts and increased government spending.

Also expected to benefit are related industries such as electric vehicle manufacturers, renewable energy providers, circular economy and climate change researchers.

Technology

Given the Democrats’ belief in innovation, the technology sector likely stands to benefit from a Harris victory in the White House. The effect is two pronged – increased government support, and a clearer regulatory landscape that could heighten investor confidence.

This policy shift could also see increased investment in artificial intelligence and digital infrastructure, providing a lift to industries such as cybersecurity, artificial intelligence, and chips making.

Harris has expressed a more balanced and friendlier touch when it comes to cryptocurrency. Notable crypto-friendly moves from Harris include discussing blockchain recently at a Wall Street donor event, building relationships with crypto-friendly Democrats, and forming an alliance with Mark Cuban, billionaire investor and well-known crypto-evangelist.

Healthcare

Another sector poised for growth in the wake of a Harris win is healthcare, given her strong emphasis on healthcare reform and affordability. Among the industries slated to benefit are telemedicine, biotech and pharmaceuticals, managed care and especially, companies involved in providing solutions for chronic diseases.

In particular, Harris’ administration is expected to continue leveraging the Inflation Reduction Act to negotiate drug treatment costs with the pharmaceutical industry. While this is deflationary towards pharma stocks, the overall increase in income is likely to balance the scale.

Conclusion

As we’ve said in our Trump Trade article, the US Presidential Election is exciting, but it’s no excuse to throw caution out of the window. If there are potential trade ideas that you think have more than a fair chance of working out for you, by all means take a closer look.

But what you should not do is to abandon your long-term plans and overly commit to risky, speculative bets. For instance, definitely don’t splurge your life savings on NFTs because you think the cryptocurrency industry will be liberated once Harris wins the election.

Ready to seize opportunities in market volatility? Open a live account with Vantage today and begin trading CFDs equipped with the insights you need to navigate the complexities of the US Presidential Elections.

References

- “How presidential elections affect the stock market – US Bank” https://www.usbank.com/investing/financial-perspectives/market-news/how-presidential-elections-affect-the-stock-market.html Accessed 7 Oct 2024

- “What impact could Kamala Harris have on markets? – Money Week” https://moneyweek.com/economy/us-election/what-impact-could-kamala-harris-have-on-the-markets Accessed 7 Oct 2024

- “Who’s ahead in national presidential polls? – ABC News” https://abcnews.go.com/538 Accessed 7 Oct 2024

- “2024 US elections: What impact could a Trump win have on the US Markets? – Money Week” https://moneyweek.com/investments/stock-markets/us-stock-markets/trump-win-impact-on-us-markets Accessed 7 Oct 2024

- “What To Expect With the Stock Market If Harris Wins the Presidency – Yahoo! Finance” https://finance.yahoo.com/news/expect-stock-market-harris-wins-140050241.html Accessed 7 Oct 2024

- “With the Fed set to cut interest rates, the dollar is losing a bit of its shine with foreign investors – Marketplace” https://www.marketplace.org/2024/09/16/us-dollar-slide-fall-fed-federal-reserve-interest-rates-exchange-rate-export-import/ Accessed 7 Oct 2024

- “Will a Kamala Harris win weaken the US Dollar? Here’s what investors are saying – The Economic Times” https://economictimes.indiatimes.com/news/international/us/will-a-kamala-harris-win-weaken-the-us-dollar-heres-what-investors-are-saying/articleshow/112724916.cms?from=mdr Accessed 7 Oct 2024

- “Kamala Harris Is Courting Crypto Investors – Benzinga” https://www.benzinga.com/markets/cryptocurrency/24/10/41168731/kamala-harris-is-courting-crypto-investors-heres-how-shes-taking-a-friendlier-approach-tha Accessed 7 Oct 2024

- “Market Views: Top 3 assets likely to gain if Harris wins – Asian Investor” https://www.asianinvestor.net/article/market-views-top-3-assets-likely-to-gain-if-harris-wins/498292 Accessed 7 Oct 2024