As the 2024 US Presidential Election draws near, all eyes are turning towards the American economy and the potential impact on its several sectors. This is not surprising, given the diametrically opposing stances towards policies and each candidate is expected to uphold as apex representatives of their respective parties.

With the race now coming down to between former-president Donald Trump and Vice-president Kamala Harris, no matter who takes the presidency, certain sectors are likely to benefit, while others might face headwinds. It all depends on how they line up in the face of each candidate’s views.

Let’s take a closer look at which sectors investors should keep an eye on.

Key Points

- Historical elections show significant sector dispersion, with industries like financials and energy seeing major shifts depending on election outcomes.

- If Donald Trump wins, sectors such as oil & gas and financial services might prosper, whereas Kamala Harris’ victory could boost clean energy and healthcare industries.

- Despite potential sector-specific impacts from the election, historical data suggests the overall market effect is short-lived, advising investors to maintain diversified portfolios and avoid basing long-term strategies solely on election results.

What can past elections tell us? [1]

First things first: It is important to understand that the US Presidential Elections tend to inspire a phenomenon known as “sector dispersion”.

Sector dispersion is a technical term that describes the difference in performance between two or more sectors, compared to the general market. During the last two elections in 2016 and 2020, sector dispersion was clearly observed. These events lend credence to the idea that election candidate policies do inspire market movements in tandem with their expected effects.

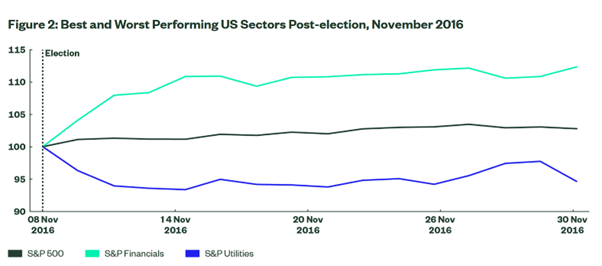

2016 elections sector dispersion

During the 2016 elections, a clear example of sector dispersion was observed in the month of November.

As displayed in the chart above, the S&P Financials index soared much higher than the general market S&P 500 index. Meanwhile, the S&P Utilities index significantly underperformed the market.

Here, sector dispersion occurred between the financial sector and the utilities sector. After polling day, the shock Trump win drove a 17% difference between both sectors. Why did this happen?

Well, Trump ran for election based on a mandate of business deregulation, believing that was the best way to stimulate economic growth. When he won, investors reacted based on expectations that he would push through policies that would result in less control and oversight over banks and financial institutions.

As a result, the Financials sector disproportionately benefited from the increased expectations of deregulation, pushing the sector ahead of others. This trend continued throughout the month of November.

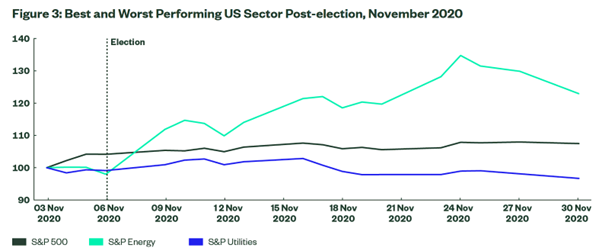

2020 elections sector dispersion

As for 2020, we once again see a clear sector dispersion taking place in the month of November (which is when the Polling Day takes place).

This time, the clear winner was the energy sector, which jumped more than 27% ahead of the worst-performing sector, utilities. During this period, the wider stock market was bullish, with the S&P 500 rising 8% throughout the end of the month.

The energy sector is largely made up of oil and gas companies. Notice how the energy index initially was headed downwards in the days prior to the election. This is because Biden ran on a platform of clean and renewable energy, and his imminent (and eventual) victory caused investors to believe oil and gas companies would face unfavourable policies. However, with the Senate remaining under Republican control, Biden’s renewables agenda faced stiff opposition and quickly faded.

This development inspired renewed market confidence in energy stocks, which explains the sector’s bull run.

Potential winners and losers in 2024

| Sectors likely to benefit | Sectors likely to face challenges | |

| If Trump wins | • Oil & gas • Financial services • Infrastructure • US Dollar | • Real Estate • Clean energy • Bonds |

| If Harris wins | • Clean energy • Healthcare • Commodities • Exports and domestic manufacturing • Bonds | • Oil & gas • Financial services • US Dollar |

Which sectors would benefit if Trump wins? [2]

Trump’s policies can be summed up as “less regulation and lower taxes”, which could drive the major economic engines of the United States.

In particular, Trump’s returning to the White House could benefit the oil & gas sector, especially given his aim to revive the coal industry while expanding oil drilling efforts on American soil. “We have more liquid gold than anybody.” Trump was quoted as saying in a recent cover story in Businessweek.

Judging by his previous presidential stint, Trump is also expected to undo or water down support for clean energy and renewable energy initiatives, further proposing up investor confidence in oil and gas.

Another beneficiary of the looser business regulatory environment Trump is expected to foster is the financial sector, such as banking and other financial institutions. Bankers are hoping that stiff rules being formulated by the Biden administration would be rolled back or even withdrawn, with one analyst expecting “less stringent capital standards”.

The infrastructure sector may also benefit from a Trump victory, as he seeks to continue delivering on his Infrastructure Act, signed into law in 2018. This could see increased demand for construction companies and infrastructure specialists for road, railway, airport and harbour projects throughout the country.

Finally, Trump’s protectionist policies and increased trade tariffs could see the US Dollar strengthening against global currencies, particularly against the Chinese Yuan and currencies from regimes Trump considers hostile to the US.

Which sectors may face challenges if Trump wins?

A Trump victory may pose headwinds to the real estate sector, as he has pledged to “promote homeownership through Tax Incentives and support for first-time buyers,” eliminate regulations on the construction of new homes to relieve the supply crunch and open up portions of federal land for large-scale housing construction. These measures could slow the growth of home prices and reduce rents, squeezing returns for real estate investors [3].

Clean energy may also take a hit, due to its position as a competitor to the oil and gas sector. Strong policy support for oil and gas could swing investor demand away from clean energy.

As trade tariffs keep the US Dollar strong, bond yields may face upward pressure. Historically, high bond yields have been linked to a poorer bond market, with total returns on the Bloomberg U.S. Aggregate Bond Index averaging -0.5% during such periods [4].

Which sectors may benefit if Harris wins?

Perhaps due to her late entry into the presidential race, Harris had not had time to clarify her view of the current economic landscape, and the policy solutions she has in mind. At least, not to the extent that Trump has.

Nonetheless, we can make some educated guesses based on her past statements and status as a Democrat.

Accordingly, two sectors that are expected to benefit from a Harris victory are clean energy, as well as healthcare. Both of these are headline topics for the Democratic Party, and Harris is expected to lead reforms in both sectors from the White House.

An increased focus on green power generation will also raise demand for commodities like lithium and rare earth minerals that play an integral role. Hence, related commodities markets could see an uplift during a Harris presidency.

In regards to international trade, a Harris administration is expected to be less hawkish, paving the way to looser monetary policy, leading to a gradual weakening of the US Dollar.

A softer US Dollar would create room for lower bond yields, offering more attractive returns to bond investors. As well, domestic manufacturers and exporters are also likely to benefit, since made-in-America goods are cheaper and more affordable to foreign trade partners.

Which sectors may face challenges if Harris wins?

As explained earlier, clean energy and oil & gas are opposing sectors, and with policy support likely to flow towards the former Harris, the oil & gas industry could face slowdowns in the aftermath.

Harris is likely to push through banking and financial regulations drawn up under the current Biden administration, which could have a chilling effect on profits and share prices in the financial services sector. The Democrats may also take the opportunity to introduce new measures to further rein the sector.

Finally, as discussed prior, a Harris administration may be more amenable towards a weaker US Dollar, so forex investors may want to take note.

Investment strategies to consider

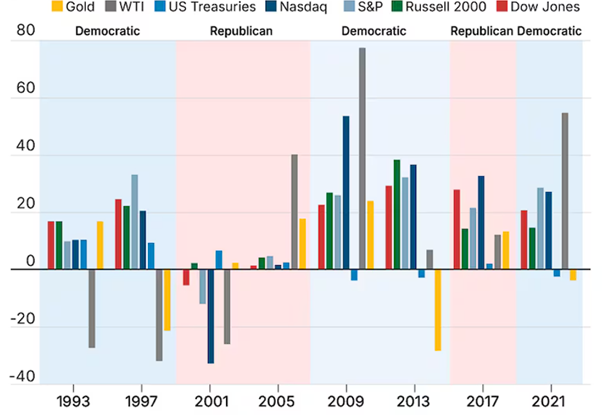

The screenshot above charts the market performance of various asset classes in the year following a US Presidential Election. You will note that there is no clear pattern or trend relating to which party wins. The only thing that is clear is that the market responds favourably a majority of the time.

This serves as an important reminder not to be too hung up on the outcome of the election, or being too invested in individual sector performance.

An analysis of historical data by the US Bank Asset Management Group found that the impact of election candidates or party control on market movements is mostly negligible, and any perceived effects are short-lived at best. Rather, it is the levels of economic growth and inflation that are more predictive of market movements than election outcomes [5].

Thus, it is recommended that investors maintain a healthy degree of diversification in their portfolios even as they ride out the short-term volatility that the election can bring.

Remember that the sectoral impact of who runs or wins is likely to be short-lived. Thus, it is prudent to be conservative with your trades and to remember to limit your risk.

Certainly, it is not the best choice to base your long-term investment strategy solely on who wins the upcoming election.

Conclusion: Watch the market, but don’t make any hasty moves

With the race deemed too close to call, the US Presidential Election is shaping up to be an exciting time. This is a good opportunity to hone your trading skills by studying the latest developments and forming your own theories as to which way the market will go.

Stay informed on US stocks and other top global markets with Vantage Academy, our in-house library of guides, articles and e-courses made to help you learn the intricacies of trading and investing. Experience our award-winning trading platforms and trade global stocks, bonds, commodities and more. Sign up for a Vantage live account today!

References

- “Elections and Equities: The Impact of the US Election on Sector Investing – State Street Global Advisors”. https://www.ssga.com/sg/en/institutional/insights/impact-of-the-us-election-on-sector-investing. Accessed 26 September 2024.

- “Watch for the Trump Trade in Banking and Big Oil – Bloomberg”. https://www.bloomberg.com/news/newsletters/2024-07-17/wall-street-s-trump-trade-focuses-on-big-oil-banking-dollar-debt. Accessed 26 September 2024.

- “Where Do Trump And Harris Stand On Housing Policy? – ABC News”. https://abcnews.go.com/Politics/trump-harris-stand-housing-policy/story?id=113618872. Accessed 26 September 2024.

- “U.S. 2024 Elections: Different Asset Classes in Focus – Century Financial”. https://www.century.ae/en/blog/us-2024-elections-different-asset-classes-in-focus/. Accessed 26 September 2024.

- “How Presidential Elections Affect The Stock Market – Forbes”. https://www.forbes.com/sites/us-bank-wealth-management/2024/09/18/how-presidential-elections-affect-the-stock-market/. Accessed 26 September 2024.